Fintech - Bridging the Gap in Underserved Segments through Digital Experience

With the increasing trend of digital adoption and the omnipresence of internet access, the Indian fin-tech market enjoys the highest adoption rate of 87%, which captures third place in the world. The fin-tech market is predicted to earn a revenue of $200 billion and reach $1 trillion AUM by 2030 1 , which is ten times greater than the current value. This phenomenal growth has been achieved through technology and affordable mobile data, which helps them to target niche segments with customised financial products.

India is making an effort for financial inclusion, but more than 160 million people do not have credit access for their financial needs 2 . Specifically, the rural population suffers more from credit access than the urban due to location, gender, and agricultural households. Some embedded financial services cover the rural segment; only 41% of farmers have financial inclusion, and the rest rely on informal financial sources 3 . According to the financial services, the primary reasons for this financial exclusion are lack of awareness, seasonal income, lack of documents, and credit history. However, lifestyle and changing patterns in rural India give hope for technology-led financial operations.

To have greater penetration in the rural market, fin-techs need to focus on the following;

Business Model: Tailoring to the Rural Market

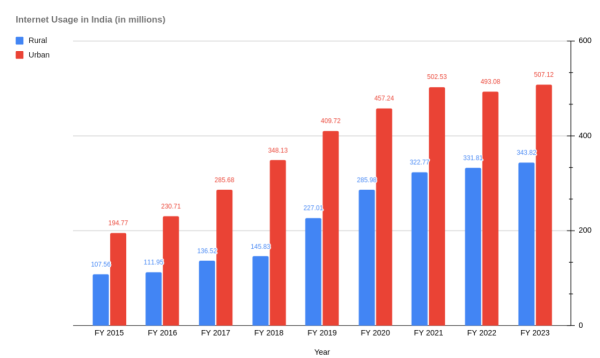

The rural market is highly scattered and heterogeneous. Therefore, adopting a common business model will not suit the credit requirements of the rural population. Rural India has 343 million internet users. While urban areas traditionally had higher internet usage, the gap has been narrowing over the years. This suggests that internet penetration is expanding rapidly in rural regions. Ironically, only one bank is available for every 17,000 rural individuals 4 , which proves that financial technology firms have a greater opportunity to fill this gap. The increasing number of smartphone users signals financial service providers to develop innovative custom-led business operations to integrate this segment seamlessly with credit access.

Rural India remains the largest underserved segment for financial services, which is a greater opportunity for financial technology companies. Adopting a rural-centric business model, customised credit products for rural people and gaining trust through user experience can help fin-techs dominate the rural landscape.

Partnerships with Local Institutions

Fintech companies can develop innovative business models integrating technology and local networks to tap into the rural market. For example, partnerships with local microfinance institutions or agricultural cooperatives can provide access to a wider customer base. By leveraging these partnerships, fin-techs can enhance their understanding of rural communities and design financial solutions tailored to their needs.

Building Trust Through User Experience

Furthermore, a successful rural-centric business model should focus on building trust through user experience. This can be achieved by offering simplified and localized interfaces, providing clear and transparent information about products and services, and delivering personalized customer support. By fostering a positive user experience, fin-techs can establish credibility and gain the trust of rural customers.

Example: Micro-loans for Small-scale Farmers

A fin-tech company specializing in micro-loans for small-scale farmers is an excellent example of a rural-centric business model. Leveraging mobile apps and digital platforms, the company simplifies the credit access process for farmers. Collaborating with local agricultural cooperatives and self-help groups streamlines loan disbursement and repayment. Through these partnerships and customized services, this fin-tech successfully addresses the credit gap in rural areas, empowering farmers to meet their financial needs effectively.

Example: Customized Agricultural Loans with Value-added Services

Another example of a rural-centric business model is a digital lending platform that offers customized agricultural loans. This platform utilizes satellite imagery and data analytics to assess crop health and estimate yield, enabling accurate credit assessments. In addition to providing credit access, the fin-tech partners with local input suppliers and agri-businesses to offer bundled services such as access to high-quality seeds and fertilizers. By combining credit solutions with value-added services, this fin-tech enhances the financial management practices of rural farmers.

Personalised credit products

Seven thousand four hundred sixty fin-techs are operating in India 5 ; in this cutthroat competition, firms must provide hyper-personalised credit products for exceptional personal experience. There are 324.9 lakh MSMEs in rural India, where one of its major challenges is the lack of credit access 6 . This gap will be an advantage for fin-techs by addressing the problem through customised products and methods. Although fin-techs offer innovative products like paperless credit, alternative credit scoring, neo-banking, flexible payment options and high personalisation is required to cater to the needs of rural communities.

Flexible Loan Structures for Seasonal Income

Fin-tech companies can tailor their credit products to meet rural individuals' and MSMEs' specific financial needs. For example, providing flexible loan amounts and repayment terms that align with seasonal income patterns prevalent in rural areas can enhance accessibility and affordability. This could involve structuring loan repayment schedules to coincide with the agricultural cycle or offering grace periods during lean seasons.

Agriculture-Specific Financing Solutions

A significant portion of rural India relies on agriculture for their livelihoods. Fin-techs can develop credit products tailored specifically to the agriculture sector. For example, providing crop loans, livestock financing, or farm equipment loans can address the unique financial requirements of farmers. These products can be designed to align with the crop cycle, allowing farmers to access funds during crucial stages such as sowing, cultivation, or harvesting.

Example: Personalized Agricultural Loans for Farmers

An example of a fin-tech company operating in rural India provides personalized agricultural loans to small-scale farmers. This fin-tech offers flexible repayment terms based on crop cycles, ensuring farmers can repay loans when their income is at its highest. Additionally, the company provides value-added services such as access to market prices, weather forecasts, and farming tips. By combining credit products with relevant support services, this fin-tech creates a comprehensive solution that caters to the specific needs of rural farmers.

Example: Data-Driven Customized Financing

Another example is a digital lending platform that utilizes historical crop yield data and satellite imagery to assess a farmer's creditworthiness. Analyzing these data points, the platform offers customized loan amounts and repayment terms that align with the farmer's requirements. Farmers can access funds for inputs, equipment, or other agricultural needs. Through data-driven insights, this fin-tech enhances financial inclusion and empowers rural entrepreneurs.

User Experience

The door-step banking is becoming obsolete, and self-banking is becoming a new norm in the financial sector. Therefore, fin-tech companies should focus on providing super apps and high-performance websites for their rural users to access products without any hurdles. The apps should cater for the needs and suit the psychology of the rural population. A simple and easy-to-use user interface (UI) exactly serves the need of simple people to understand their financial options and products to make better decisions. Multiple language support on the digital interface can complement rapid expansion in these markets. In many rural areas, 4G networks are not widely available, and thus, fin-techs focus on improving the pleasant digital experience even with the low internet speed. On the other hand, the digital medium needs to support safe and secure transactions, which is key to high rural adoption.

The Rise of Self-Banking and Super Apps

Fin-tech companies should develop super apps or all-in-one platforms that offer a range of financial services in a single, intuitive interface. These apps can access banking services, credit products, investment options, insurance, and more. Additionally, high-performance websites that load quickly and offer seamless navigation are essential for users with limited internet connectivity.

Catering to Rural Users: Simplifying UI and Language Support

The user interface (UI) and overall design of fin-tech platforms should cater to the needs and preferences of the rural population. This involves employing clear and simple language, intuitive icons, and visual aids to help users easily understand their financial options and products. Avoiding complex jargon and incorporating user-friendly features like voice-guided instructions can enhance accessibility.

To cater to the diverse linguistic landscape of rural India, fin-tech platforms should offer multiple language options. By providing interfaces in local languages, fin-techs can ensure that rural users feel comfortable and confident in accessing financial products and services. This inclusivity can significantly improve user engagement and adoption rates.

Optimizing for Limited Internet Connectivity

Access to high-speed internet, particularly 4G networks, is limited in many rural areas. To address this challenge, fin-tech companies focus on improving the digital experience even with low internet speeds. They optimize their platforms to load quickly and provide seamless navigation, enabling users to access information and conduct transactions efficiently, even in areas with limited connectivity. This optimization ensures that rural users enjoy a pleasant and uninterrupted digital experience.

Example: Super App for Rural Financial Services

A fin-tech company operating in rural India could develop a super app that offers a range of financial services tailored to the needs of rural users. The app features a user-friendly interface with clear icons and instructions, simplifying the navigation and accessibility of banking services, microloans, insurance products, and more. Language support in local dialects ensures that users can interact with the app comfortably. The app's low internet speed optimisation allows seamless transactions and information access, overcoming connectivity limitations.

Example: Agricultural Finance Platform for Farmers

Another example is a fin-tech platform focusing on agricultural finance for rural farmers. The platform's website is optimized to load quickly and perform well, even with limited internet connectivity. The user interface is designed with simplicity in mind, using clear language and visual aids to help farmers understand their loan options, calculate repayment plans, and access personalized agricultural insights. The platform ensures data security and privacy through encryption technology and regular audits, instilling trust among rural users.

Conclusion

The Indian fintech market has tremendous potential to bridge the gap in financial services for the underserved rural population. The high adoption rate of digital technology and the widespread availability of internet access present favourable conditions for fin-tech companies to make a significant impact. By adopting a rural-centric business model, offering personalized credit products, and prioritizing user experience, fin-techs can dominate the rural landscape and drive financial inclusion.

To succeed in rural markets, fin-tech companies must tailor their business models to rural communities' unique characteristics and needs. This includes forging partnerships with local institutions, leveraging technology to develop innovative solutions, and building trust through user experience. By collaborating with microfinance institutions, agricultural cooperatives, and other local networks, fin-techs can tap into a broader customer base and gain a deeper understanding of rural communities. Through customized credit products that address the specific challenges faced by rural individuals and MSMEs, fin-techs can provide accessible and affordable financial solutions that empower rural customers to thrive.

Furthermore, delivering a seamless and user-friendly digital experience is crucial for rural adoption. Developing super apps and high-performance websites that cater to the preferences and constraints of rural users, such as simplified interfaces, multiple language support, and optimized performance in low-connectivity areas, is essential. Fin-techs can foster trust and drive engagement by ensuring that rural customers can easily navigate and access financial products and services. Ultimately, by embracing a rural-centric approach, fin-tech companies can revolutionise rural India's financial landscape, empowering millions of underserved individuals and driving inclusive economic growth.

If you are eager to enhance and transform your digital financial services experience to cater to the needs of rural India, our team of digital consultants is ready to assist you on this transformative journey. We understand the unique challenges and opportunities in serving rural communities, and we can help you develop tailored solutions, user-friendly interfaces, and innovative business models. Contact us now to collaborate and unlock the full potential of the rural fin-tech market.